Unleash Your Unique Musical Strengths

AND LAND PAID GIGS

~ NOMAD (Founder/CEO)

GET THE GIG

Much more than a job, a CAREER MUSICIAN is someone who can't stop making music even if they tried. It's their gift, passion, and their purpose!

However, getting "The Gig" – is not just about prepping for the audition but the prep-work of networking, building a solid reputation, getting the right gear, and so on...it really is All the things.

KEEP THE GIG

Once you have the gig, how do you keep it? We believe the first step is knowing this simple truth – Your value is not determined by the gig.

Your value is determined by what you provide to others: Work ethic, consistency, professionalism and your overall ability to adapt in a world that is by nature, competitive and challenging.

GO BEYOND THE GIG

The Career Musician exists to empower musicians just like YOU with strategies for a sustainable career. Simply put, we teach you how to make a living making music!

Whether you're just starting out, or currently working as a musician, there is much more than just money to be made. There's a Career and we're here to get you on the Fast Track to Success!

Tom Flint

Sound On Sound Magazine

"Nomad's sample library material is immaculately played, if not always perfectly, to provide any composition it's used in with a very polished feel. What's more, its no‑nonsense approach will be welcomed by professionals looking for bread‑and‑butter material."

Alejandro Calderon

Coaching Client

“Super excited to have gotten to do a one on one coaching session with Nomad! We had the chance to discuss my goals and what I’m trying to achieve as a Career Musician! Walked away with a clear plan of attack and the knowledge that he offers from experience on how to achieve what success looks like for me. Definitely well worth the money and time!”

Ian Abel

ETHOS Customer / Mentee

"Nomad is a beacon for musicians caught in the depths of a tumultuous music sea. With his help, I landed the gig with an established Country artist which afforded me to the opportunity tour the US, which established me as legit player in the competitive Nashville music scene."

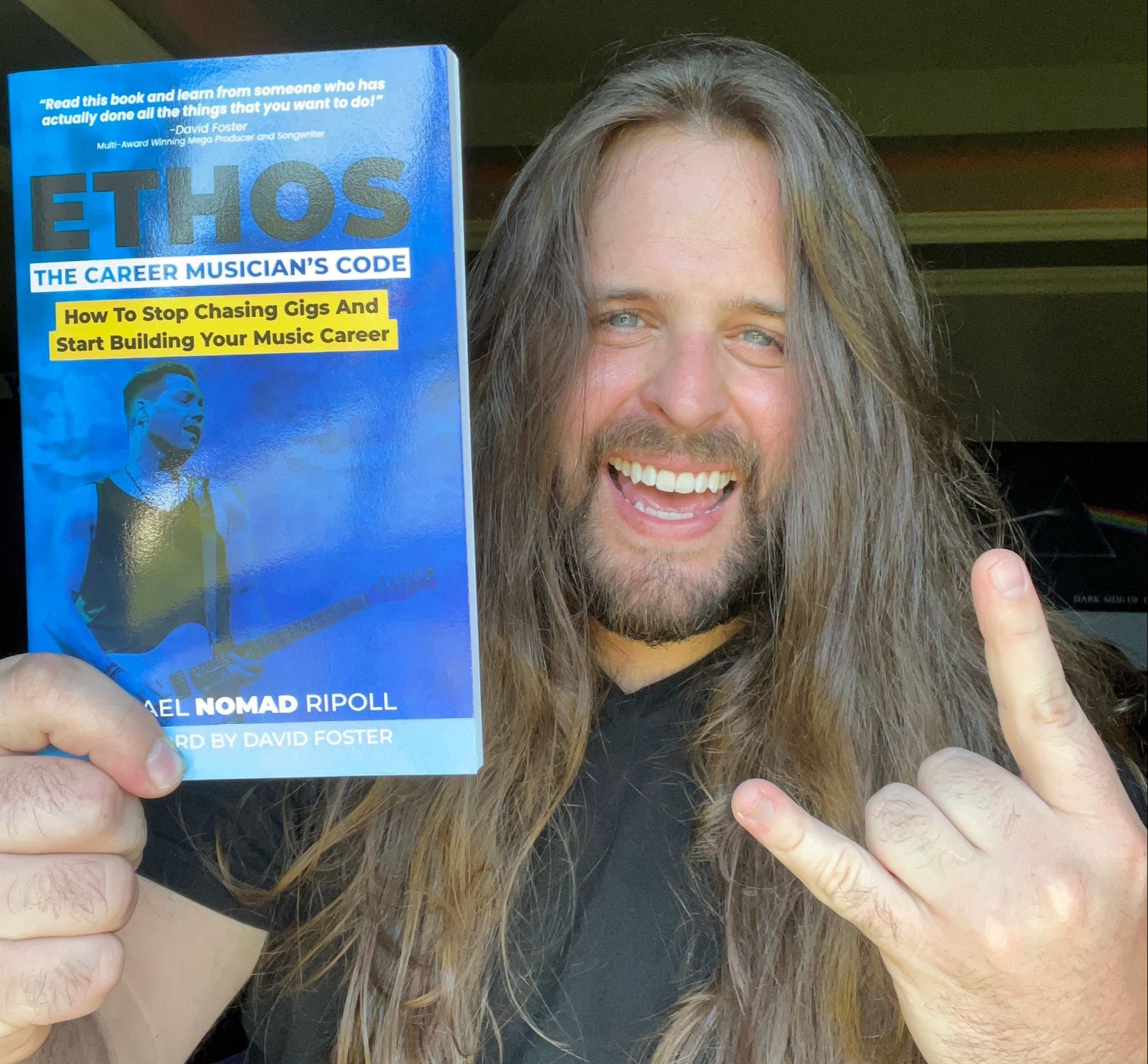

WHO IS NOMAD...

A 30-year music veteran, NOMAD (👈 click for list of credits), is on a mission to Empower Musicians with Strategies for a Sustainable Career in Music!

Believe it or not, you've probably already heard Nomad's guitar playing and music! With countless TV shows and movie scores on his resume, plus the fact that he's shared the stage and/or studio with a list of musical icons from A to Z... Aretha Franklin, Justin Bieber, Beyoncé, Celine Dion, Thundercat, Carrie Underwood, Jennifer Hudson, Kenny Babyface Edmonds, Fantasia, David Foster, Kelly Clarkson, El DeBarge, Stevie Wonder, Ledisi, KEM, Barbra Streisand, Sting and so many more, Nomad is a tried and true Career Musician.

What started as a passion-project podcast, has flourished into a platform for musical excellence that's more than just a gig service, or coaching/teaching space. This is a lifestyle that Nomad has created for himself as the proof of concept, and now he's sharing it with all who wish to make their passion more than just a job, but instead turn it into a lifelong CAREER!

🎵 TAKE NOTE OF MY NO B.S. POLICY 🎵